The Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) is currently receiving applications from small businesses across the country as part of its N5 million matching fund programme.

Funded by SMEDAN and the Bank of Agriculture (BOA), collateral-free loans of between N1.2 million to N5million will be made available to prospective beneficiaries.

Director-General of SMEDAN, Dr Dikko Umaru Radda disclosed that the loans would be financed from the SMEDAN-BOA Matching Fund for small businesses. The Bank of Agriculture will be in charge of paying out the loans, according to Radda.

The Matching Fund programme is aimed at providing small businesses with extra capital to improve production output, viability and scale of operation.

Target beneficiaries of this programme shall be labour-intensive micro or small enterprises (MSEs) operating in the real sector. These shall ideally be innovative value-added products that are establishing footprints in the Nigerian market and require additional funds to increase output.

Dr Dikko Radda, DG SMEDAN

Eligibility

Applicants for the SMEDAN matching fund should be Nigerian micro or small businesses operating in the Federal Capital Territory (FCT), Oyo or Kaduna state. All businesses applying for the fund must be duly registered with the agency and have been assigned a SMEDAN Unique Identification Number (SUIN).

Also, businesses should possess a Tax Identification Number and be registered with the Corporate Affairs Commission.

How to Apply

Before you start your application, ensure that your business is registered with SMEDAN. Go to the MSME mass registration portal to register.

Here’s how to apply for the N5 million SMEDAN fund:

1. Apply through the BOA-SMEDAN Fund Portal

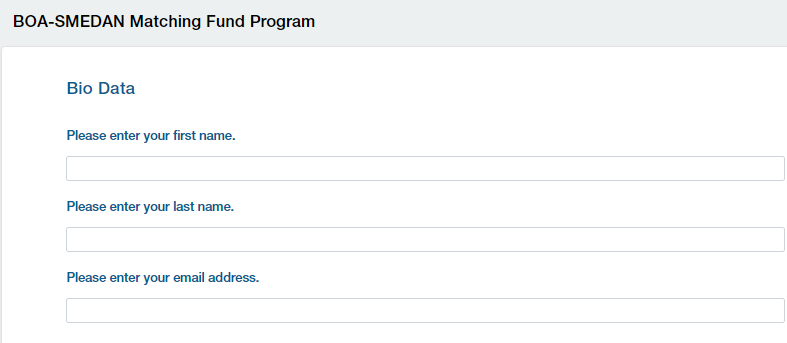

To begin your application, log on to the BOA-SMEDAN fund portal. All sections are required. Scroll down to continue.

2. Enter Personal Details

Simply fill in your first name and last name. Then enter your business email address. Do not use your personal email.

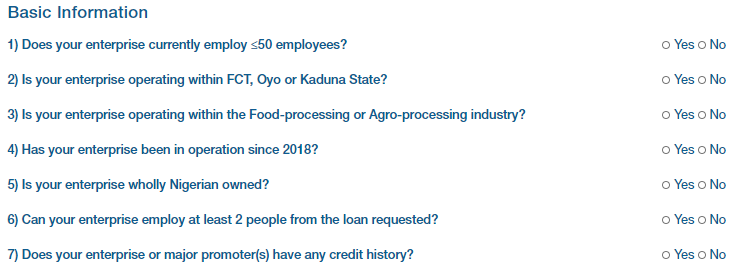

3. Supply Basic Information

At this stage, you are to provide answers to each of the seven listed questions. The questions range from the number of employees at your organisation and business location to recruitment capacity post-loan and credit history. Tap on “Yes” or “No” to answer.

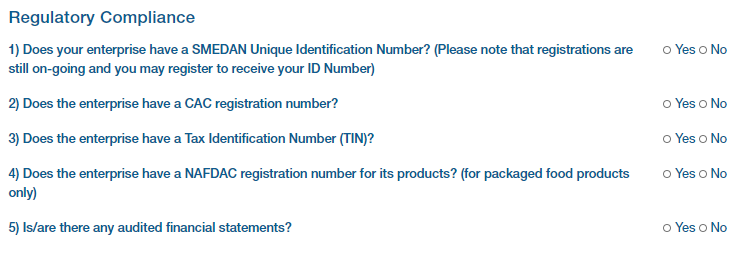

4. Answer Regulatory Compliance Questions

Here, you are to answer questions showing whether you fulfil the eligibility criteria for the fund. In all, there are five (5) questions including those on the status of your SMEDAN registration, CAC registration and financial statements.

If your business is into food production/packaging, you should have a NAFDAC registration number for your products.

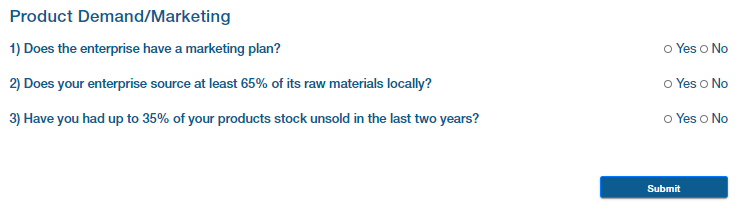

5. Complete Product Evaluation and Submit

This is the last stage of your application. Answer the questions based on the figures from your business operations.

Review your answers and ensure there are no errors, then click “Submit” to finish.

-Technext