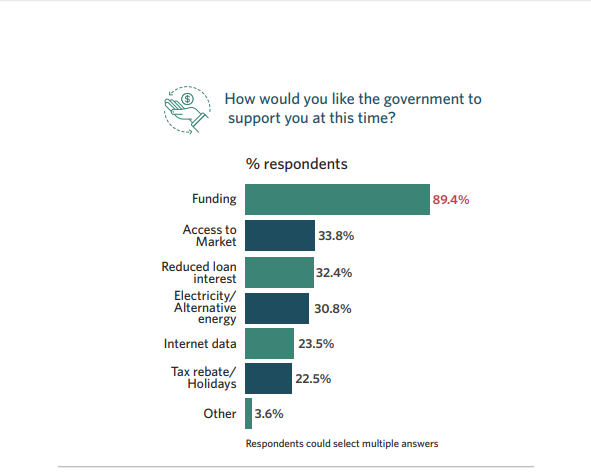

Nigerian Micro, Small, and Medium Enterprises (MSMEs) have listed funding, access to market, and reduced loan interest as top needs during Novel Coronavirus.

This is the outcome of the impact of the COVID-19 pandemic on small businesses in Nigeria conducted by the FATE Foundation in partnership with BudgIt Nigeria.

The survey engaged relevant stakeholders within the entrepreneurship ecosystem around designing solutions and interventions to support Nigerian MSMEs during and post COVID-19. It was targeted at micro, small and medium businesses across the 36 states in Nigeria including the FCT.

According to the survey, 89.4 percent of respondents want the government to open up access to funding for small businesses. 33.8 percent and 32.4 percent want the government to increase access to the market and reduce loan interest respectively.

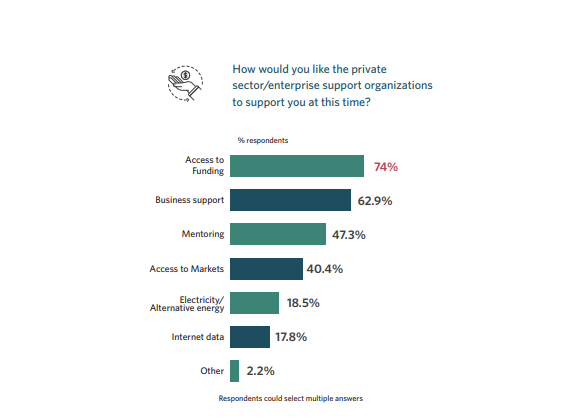

When asked about the kind of support business firms required from the private sector, funding also tops the list with 74 percent. In the private sector part, they also want mentorship and business support.

The survey recommends that the need to build and enable MSME resilience should include flexible financing programmes, virtual business support services, and non-financial support through regulatory reliefs and programmes which support vulnerable segments such as women and young entrepreneurs.