It can get really confusing when you find that you make sales almost every day in your business, and yet find it hard to get any profit at the end of the month. Now, this is not the regular case of someone who spends business money on personal needs. You can be spending business money on business, and yet still find that your expenses are draining the life out of your business.

There are several reasons why this could be happening, and here are three of them.

Confusing revenue for net profit

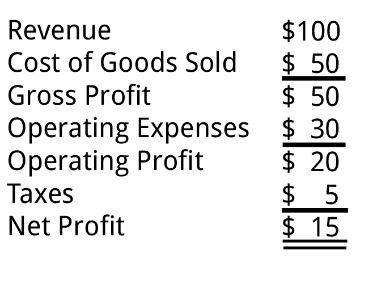

If you sell 10 units of footwear in one day at a selling price of N5,000, you will have a total revenue or N50,000. BUT, you do not have a net profit of N50,000.

To differentiate your net profit from your total revenue, you need to have a comprehensive list of all your expenses and costs. Let’s assume that you bought the footwears at a cost price of N25,000, paid transportation/logistics cost of N5000, spent N5,000 on sponsored ads and promotions, N3,000 on internet data subscription, and N2000 on packaging materials and label. This would mean your expenses total to N40,000.

To calculate your net profit, you should subtract the expenses from the revenue.

However, what we find is that most people rejoice after making sales and then go ahead to make plans based on that revenue as though they were spending the net profit. And at the end of the month, they sit down to start wondering where all the money went.

If you must remain in business, you should be disciplined enough to keep a comprehensive record of your expenses, and properly calculate your net profit when sales are made. Cash is the most critical and liquid resource, and how well you understand it can determine your financial flexibility, and operating capacity.

Ignoring or overlooking the not-so-obvious costs.

For the most part, if business people have to list their operations costs, they quickly reel out the regular costs that occur daily, or even monthly. The list will have things like packaging, marketing, remuneration for the team, raw materials, inventory, and maybe utilities. However, the not-so-obvious costs like rents, website hosting and platform subscription, trademarks, permits, licenses (which you probably pay once in a year or in two years), are quite likely to be left out of the list.

How does this affect you?

Instead of taking out a fraction of this cost from your monthly budget throughout the year, you end up waiting till the bill is due, and then you have to pull out a bulk sum at once. Depending on the size of your inventory, pulling out a huge sum can send your business under the waters or even deeply shake you up.

There is no way around it. You have to be thorough when listing out your operations costs. We have a post on fixed and variable costs for businesses. It is quite descriptive and can come in handy when you want to draw up your list.

Pursuing new projects and strategies not listed in the budget

Now, this point is totally based on the assumption that you prepare a monthly or quarterly budget for your business ahead and work with that budget. If you don’t work with a budget, you are in an even worse situation.

Imagine that in the second week of the month, there is a sudden rave about an exciting new marketing strategy or a sales tactic that is making lots of sales for other business owners, what do you do? Do you suddenly jump on the train even though you had no earlier plans or budget for it (afraid to miss out on the opportunity)? Or do you take some time to study it, and then add it to the next month’s budget?

A lot of business owners will get overly excited and make the mistake of pursuing it without considering how it affects other elements of their monthly budget. Even though it was not budgeted for, they will spend huge cash to get it in motion. This can drain your business significantly, especially when you do not get the sales you hoped for, due to inadequate planning or other factors.

This of course, does not mean that your budget should have no room for flexibility. It just means you do not have to make an unplanned purchase at the expense of something well-thought and already fitted into your budget. Check and see if the new (large) expenditure can fit into the current budget cycle or if you need to push it to the next budget cycle.

Bottomline

Cashflow is like the bloodline of the business. If you keep making mistakes with money, your business could bleed to death.