Many individuals and small business owners today make online payments (mostly in dollars) for one thing or the other. It could be paying for a Netflix subscription, crediting virtual wallets for Facebook / Instagram Adverts, or paying for purchases on Amazon and Spotify. If you make purchases online, what payment alternatives are available to you? Do you use a virtual dollar card for such transactions?

With the $20 daily limit on international transactions by Nigerian banks, your best option might actually be these virtual dollar cards. Here are some options to consider the next time you need to make an online payment using a virtual dollar card. Keep in mind that each of these card options has its limits and restrictions, so as you read through, try to decide which one works best with your business needs at the moment.

Cashbuddy Virtual Dollar Card

Cashbuddy is a platform that tries to simplify how businesses in Africa pay and get paid. Part of its features includes allowing you to create a cash card (in any currency, including dollars) with which you can make payments and carry out other transactions.

Create a Cashbuddy account, log in, load your cash card with your local currency and convert it to any preferred currency. You can use it to receive and make payments for goods and services on global platforms, including all social media platforms, Skrill, Amazon, Apple Music, Stripe, Binance etc. If you are in Nigeria, this is a solid payment alternative that you can use to purchase goods and services from across the globe.

The maximum limit on this virtual card is $10,000 monthly. Cashbuddy prides itself on having zero hidden charges. It also offers other services like converting airtime to cash.

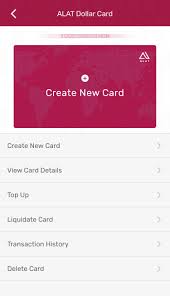

ALAT Virtual Dollar Card

The Alat Virtual Dollar Card is a card that has its denomination in dollars. It is a virtual card that can be used to pay for goods and services on websites or apps that accept MasterCard or Visa Card options for dollar payments. When you create the card, you get all the necessary card details that you need to make online payments, like the card number, expiry date, and the three-digit CVV code.

You can create an Alat account and get a domiciliary account that you can use to receive payments in other currencies. These payments can become the funds for your virtual dollar card, or you can use the funds in your naira account (at current bank rates) to fund your virtual dollar card. There are explainer videos on how to create and use the virtual dollar card online. The maximum amount that you can have on the card is $20,000. For safety reasons, after every transaction, you can return the remaining funds into your regular naira account and only fund the dollar card when you need to.

Chipper Cash Visa Virtual Card

The Chipper USD Card is another valid alternative if you want to pay for your online shopping and subscriptions on international platforms. It works the same way as your regular cards, and you get all the card details on the app after creating the card.

First, you need to have downloaded and created a wallet on the Chipper Cash app. Next, activate your Chipper Virtual Dollar Card in minutes, and you are ready. If you create the Chipper Cash Virtual Card soon enough, you can enjoy their recently announced 5% cashback promotion, where you get 5% cashback on every international transaction.

Interestingly, there are no extra charges for international transactions. However, you can only use the card on platforms that allow Visa Card payments. You can neither deposit nor withdraw more than $1000 on the virtual dollar card daily.

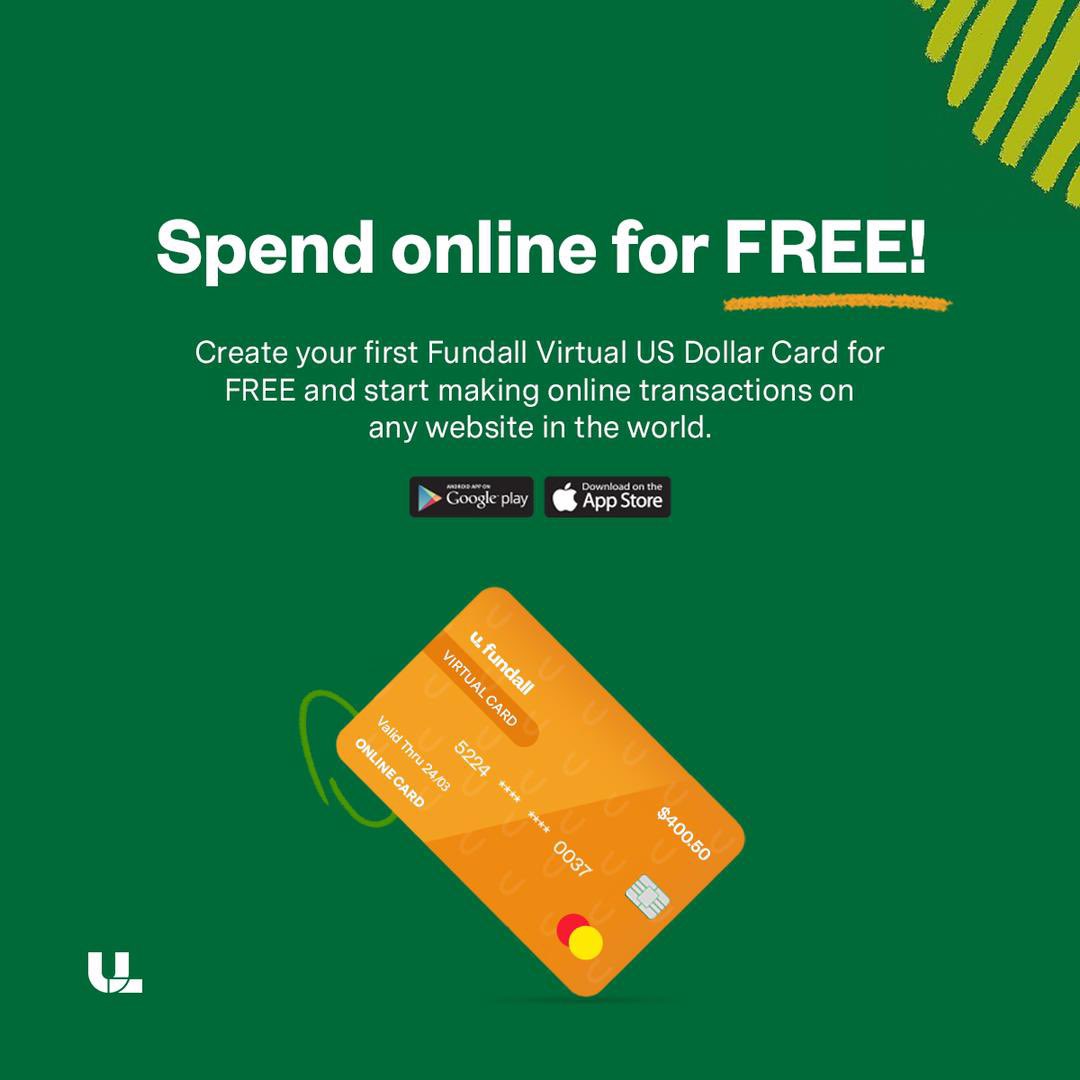

Fundall Virtual Dollar Card

Fundall is a Nigerian digital bank that provides a platform for individuals and small business owners to access and have their own virtual dollar Mastercards. You can use it to pay online without restrictions, as most websites and apps accept Mastercard payments. You would get the card details after getting your virtual dollar card for free. There are no upper transaction limits, but there is a lower limit of $5.

To get it, download the app and register. Then, go to the Spend option, select cards, and follow the prompts. Afterward, fund the card and you are good to go.

Wallets Africa Virtual Dollar Card

Wallet Africa is another fintech platform that allows individuals and small business owners in Nigeria to create virtual dollar Visa cards and use them for all forms of online payment.

Once you download the app from the Playstore, sign up, you’ll get a free virtual dollar card. If you want a physical dollar card delivered to your doorstep, it is available at a fee. The card has other great features like instant account statements.

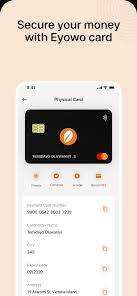

Eyowo Visa Virtual Dollar Card

Unlike the other options we have discussed, Eyowo is the only platform that allows you to sign up for a virtual dollar card with just a phone number and fund the card with as low as 1 dollar. The fintech company also allows cardless ATM withdrawals. You can download the Eyowo mobile app from the Playstore, sign up and request for the Eyowo dollar card. You can then fund the card and start making your online payments.

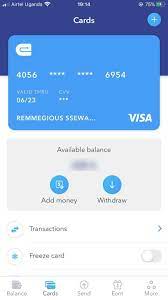

Eversend Virtual Card

Eversend offers virtual dollar Mastercards to users in Nigeria to pay for goods and services online. As an Africa-based mobile-only bank, Eversend also allows you to hold a multi-currency wallet on the app; GHC, KES, NGN, RWF, UGX & USD. With this, you can exchange, save, and send money within and across the continent. You can also generate a payment link for your customers to make payments in different currencies. There is an added feature of freezing and unfreezing your Eversend virtual card anytime to protect against fraud. When you’re done with your transactions, you can freeze the card until you need it for the next payment.

To use this option, download the Eversend mobile app, sign up, create the card and fund it. There is a lower limit of $5 on your virtual dollar card.