Funds are critical for the sustainability of any business. What you do with the funds is even more important. As a business owner, you should have savings and investments in your financial management plan especially when you have gone past the early days of scrimping through your finances.

Every business has its risks, and there are several ways you can manage the risks depending on the sector your business falls into, and the volatility it is exposed to. You may opt for an insurance plan to secure your business capital. You could split your efforts into several parts, and choose to save or invest a portion or two into other secure assets. You could channel a portion of your profit into hedge funds. Consider the fact that between December 31, 2021 and August 1, 2022, the naira has depreciated about 25% against the dollar (black market rate), and imagine what your fate would have been if you had some assets stowed in foreign currency.

Importantly, building an asset portfolio is good for your business financial health, and can also contribute to your credit score rating if you need to raise more funds for your business in the future. It will also contribute significantly to your business valuation, if and when you start exploring corporate deals like mergers and the likes.

There are several options, and it will come down to the level of your financial knowledge and your discussions with your financial advisor. However, there are some financial platforms that offer you savings and investment options that you could use to secure and hedge your funds against inflation. The options we have listed here do not include the options you may get from the commercial banks. However, these are all fully registered financial institutions. You may visit their website, do further research and speak with your financial advisor before reaching a decision on what to do with your free funds. The list is by no means exhaustive.

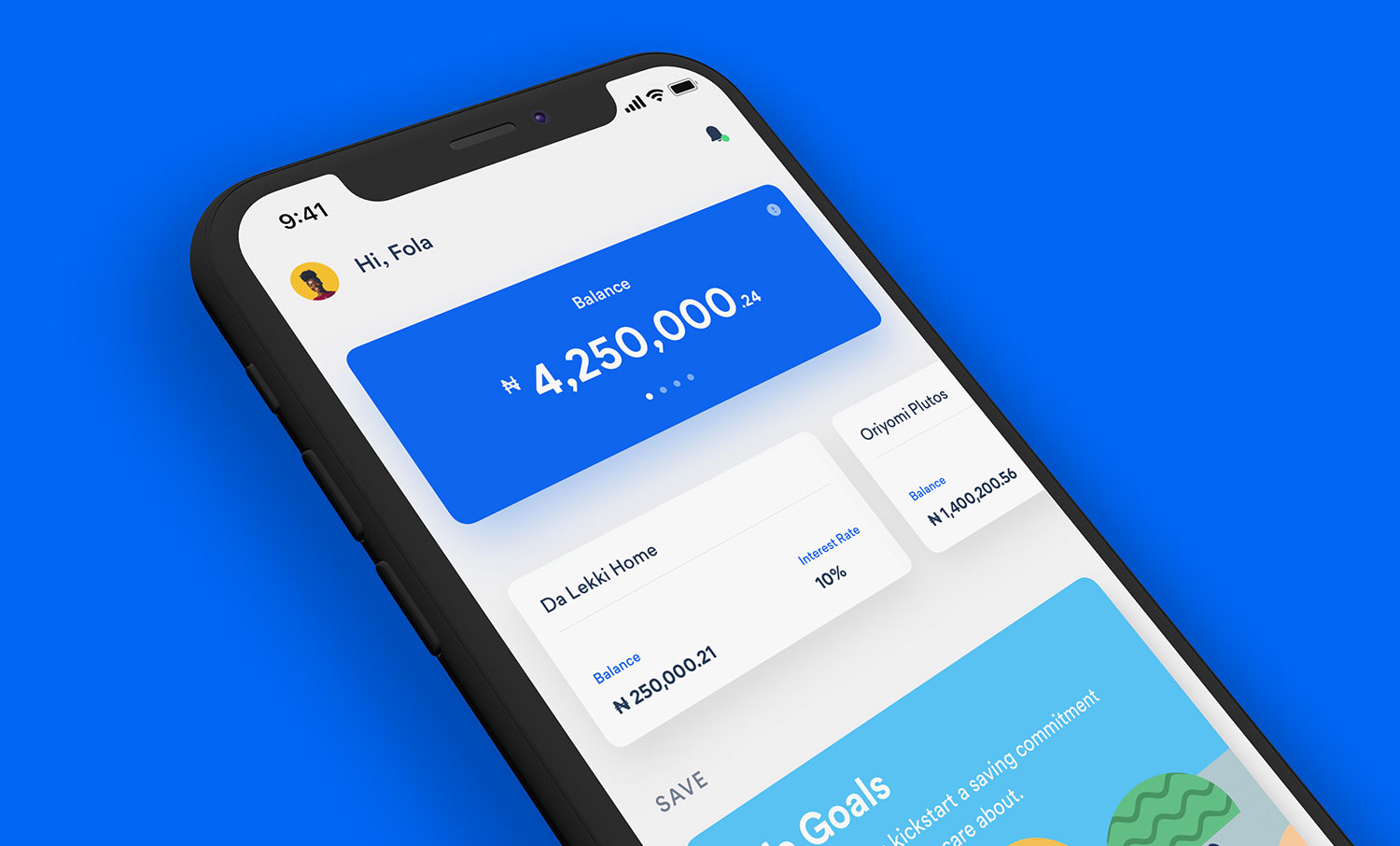

Alat by Wema bank

Alat is a wholly digital bank owned by Wema Bank that allows you to save, and pay bills from anywhere. Alat also has savings plans that you could consider if you are looking to put away lose cash as a small business owner. There is the Fixed Goals where you save daily, weekly or monthly for a period and you can earn some interest on the money as well. There is also the Stash option as well as the group savings where you can team with friends to save towards a goal. There are plans that allow you to get your interest upfront, monthly or at the end of the tenor. You could be getting up to 8 percent per annum.

Alat is a wholly digital bank owned by Wema Bank that allows you to save, and pay bills from anywhere. Alat also has savings plans that you could consider if you are looking to put away lose cash as a small business owner. There is the Fixed Goals where you save daily, weekly or monthly for a period and you can earn some interest on the money as well. There is also the Stash option as well as the group savings where you can team with friends to save towards a goal. There are plans that allow you to get your interest upfront, monthly or at the end of the tenor. You could be getting up to 8 percent per annum.

Bamboo

Originally, Bamboo was created as an investment solution to help Nigerians conveniently invest in dollar-based stocks and assets, for the purpose of hedging against inflation or simply diversifying their portfolio. To profit from this, one needed to have sufficient knowledge of the foreign stock market, know the right stocks to buy and when. However, Bamboo recently launched a savings package that saves you all that trouble. So if you do not follow the global stock market happenings, and are not sure what dollar-based assets you should be buying, then you could simply use the savings package and get up to 8% returns per annum. You can pick Considering that this saving is done in dollar, a properly structured financial plan can see you building an asset base that will hedge you against inflation and other business risks. Read up more on the website/app and see if this option is for you.

Cowrywise

Cowrywise has several savings and investments package that a business owner can find helpful. There is the monthly savings plans that gives you up to 7.5% per annum. There are Dollar Mutual funds, Naira Mutual Funds and other investment options you could find interesting. Depending on how knowledgeable you are in financial investment, you could choose any of the investment plans. Otherwise, you can simply do the savings plan that works best for you. There is more information on this on the Cowrywise website, app and social media handles.

Cowrywise has several savings and investments package that a business owner can find helpful. There is the monthly savings plans that gives you up to 7.5% per annum. There are Dollar Mutual funds, Naira Mutual Funds and other investment options you could find interesting. Depending on how knowledgeable you are in financial investment, you could choose any of the investment plans. Otherwise, you can simply do the savings plan that works best for you. There is more information on this on the Cowrywise website, app and social media handles.

Ladda

Ladda is best described as a solution that provides several financial services in a single platform. Portfolio management, global stocks, gift cards, savings, mutual funds and a myriad of investments are some of the options on the app. Tosin Olaseinde, the founder of Money Africa, is the brain behind Ladda and she launched it as an option for users with a low-risk appetite to access high-interest savings options. There is the savings that

offers as high as 10% per annum, and a small business owner can easily use it to put away funds regularly, earn interest and watch it grow. There are also mutual funds, both naira and dollar, which offer returns up to 7% per annum.

Ladda is the only African startup that has made it to the final stage of the Seedstars competition, a testament to the viability of the platform. If you are interested in using Ladda, you can read up more on the website, download the app, discuss with an expert and decide which to get started with.

Piggyvest

Piggyvest was designed for people who find it hard to explain where their lose funds go to. It can be used as your digital piggybank to put away money at regular intervals. The platform pays you interest when you save money with them. You can get up to 10% per annum on the Core Savings plan(Piggybank Savings); up to 13% per annum on the SafeLock option; and up to 10% per annum on both Target and Group Savings. You can also choose whether you want to save in foreign currency like dollar and pounds, or you want to stick with the naira.

Piggyvest was designed for people who find it hard to explain where their lose funds go to. It can be used as your digital piggybank to put away money at regular intervals. The platform pays you interest when you save money with them. You can get up to 10% per annum on the Core Savings plan(Piggybank Savings); up to 13% per annum on the SafeLock option; and up to 10% per annum on both Target and Group Savings. You can also choose whether you want to save in foreign currency like dollar and pounds, or you want to stick with the naira.

If you are knowledgeable about investments, you can look at the Investify option where you can

make up to 25% in returns over time. The interesting thing about Piggyvest is the range of options it

serves you. It almost seems like there is something for everyone.

VFD Microfinance Bank

VFD Microfinance Bank is a wholly online bank that allows you to simply download the app from the playstore, create a bank account in minutes and start banking. You can also get an ATM card by requesting one on the app and having it delivered to your doorstep. As a small business owner trying to properly manage your finance, what you may find interesting is the savings plan. Using the fixed deposit option on the app, you can earn up to 14% per annum on your money which is way more than what most others offer. You can fix your deposit for 8 months, 9 months, etc. The interesting thing is that if a business emergency comes up, you can liquidate a part or all of the deposit to solve the problem. This attracts a small fee on the already accumulated interest, and not on your capital. The caveat here though is that you are saving in naira, and as such still exposed to currency depreciation. Hopefully, the 14% interest should be able to compensate for this.

VFD Microfinance Bank is a wholly online bank that allows you to simply download the app from the playstore, create a bank account in minutes and start banking. You can also get an ATM card by requesting one on the app and having it delivered to your doorstep. As a small business owner trying to properly manage your finance, what you may find interesting is the savings plan. Using the fixed deposit option on the app, you can earn up to 14% per annum on your money which is way more than what most others offer. You can fix your deposit for 8 months, 9 months, etc. The interesting thing is that if a business emergency comes up, you can liquidate a part or all of the deposit to solve the problem. This attracts a small fee on the already accumulated interest, and not on your capital. The caveat here though is that you are saving in naira, and as such still exposed to currency depreciation. Hopefully, the 14% interest should be able to compensate for this.